The 25-Second Trick For Custom Private Equity Asset Managers

Wiki Article

The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

In Europe - a much more fragmented market - the relationship between buyout funds and public equity is far lower in the same period, occasionally negative. Since exclusive equity funds have far a lot more control in the firms that they invest in, they can make more energetic decisions to react to market cycles, whether coming close to a boom period or a recession.

In the sub-section 'Exactly how private equity influences profile returns' over, we saw how consisting of private equity in an example profile boosted the overall return while likewise enhancing the overall threat. That said, if we consider the same sort of instance put in different ways, we can see that including personal equity increases the return disproportionately to enhancing the risk.

The standard 60/40 portfolio of equity and set revenue assets had a threat level of 9. 4%, over a return of 8.

Custom Private Equity Asset Managers Fundamentals Explained

By consisting of an allotment to exclusive equity, the example portfolio danger enhanced to 11. 1% - however the return additionally enhanced to the very same figure. This is simply an instance based upon an academic profile, yet it demonstrates how it is possible to use private equity allowance to diversify a portfolio and permit better inflection of danger and return.

Moonfare does not offer financial investment recommendations. You should not interpret any information or other material supplied as lawful, tax obligation, financial investment, financial, or other suggestions.

A link to this file will be sent out to the complying with e-mail address: If you want to send this to a read this various e-mail address, Please click below Click on the web link once again. Syndicated Private Equity Opportunities.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

After a while, the owners money out, retiring someplace warm. Managers are employed. https://cpequityamtx.bandcamp.com/album/custom-private-equity-asset-managers. Shareholders are no more running the organization. This implies that there is an unavoidable wedge in between the interests of supervisors and ownerswhat financial experts call company prices. Agents (in this situation, supervisors) may choose that benefit themselves, and not their principals (in this situation, proprietors).

The firm survives, however it ends up being bloated and sclerotic. The resources it is usinglabor, funding and physical stuffcould be used much better somewhere else, yet they are stuck due to the fact that of inertia and some residual a good reputation.

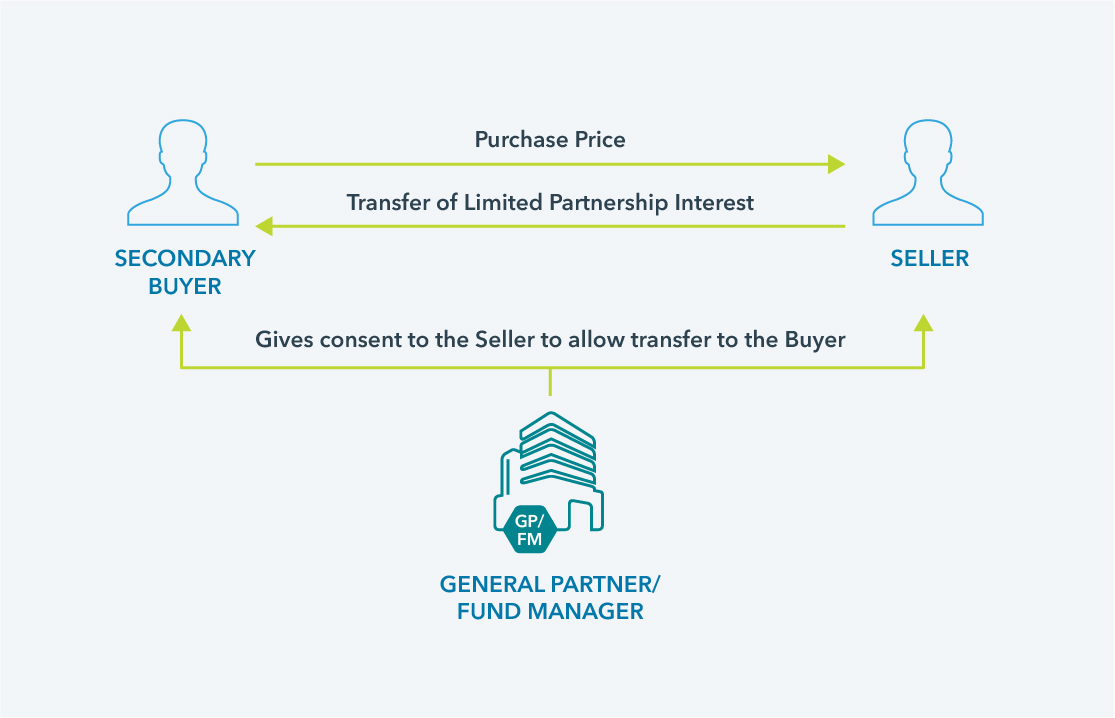

In the typical exclusive equity investment, a financial investment fund makes use of cash elevated from wealthy individuals, pension funds and endowments of universities and charities to get the company. The fund borrows money from a bank, using the properties of the firm as security. It takes control of the equity from the distributed shareholders, returning the business to the location where it was when it was foundedmanagers as owners, as opposed to agents.

Custom Private Equity Asset Managers Fundamentals Explained

The personal equity fund installs monitoring with many times that risk. Chief executive officers of private equity-funded firms regularly get five percent of the business, with the management group owning as a lot as 15 percent.

By doing this, the worth of personal equity is an iceberg. The couple of business that are taken private each year, and the excess returns they make, are the bit over the water: big and crucial, however rarely the whole tale. The gigantic mass below the surface area is the companies that have far better monitoring due to the fact that of the danger of being taken over (and the administration ousted and changed by private equity execs).

Firms aresometimes most efficient when they are personal, and occasionally when they are public. All companies start out exclusive, and many grow to the point where offering shares to the public makes feeling, as it allows them to reduce their expense of resources.

Little Known Questions About Custom Private Equity Asset Managers.

The doors of funding have to swing both methods. Personal equity funds offer an important service by completing markets and letting companies optimize their worth in all states of the world. Requisitions do not constantly work. While private equity-backed business surpass their private market rivals and, researches reveal, execute better on employee security and other non-monetary measurements, sometimes they take on too much debt and die.

Villains in business flicks are typically financial investment types, rather than home builders of things. Before he was retrieved by the prostitute with the heart of gold, Richard Gere's character in Pretty Lady was an exclusive equity man. After that he determined to develop watercrafts, as opposed to purchasing and separating firms.

American culture commits significant resources to the exclusive equity market, yet the return is paid back many-fold by raising the efficiency of every service. We all take advantage of that. M. Todd Henderson is professor of law at the College of Chicago Law College. The views revealed in this post are the writer's very own.

Not known Details About Custom Private Equity Asset Managers

Newsweek is devoted to difficult conventional knowledge and finding connections in the look for typical ground. Private Investment Opportunities.

"In addition, we additionally located unfavorable results on other measures of individual wellness. For instance, scores on wheelchair, ulcers, and pain. We find a systematic, regular image of patients doing even worse after the assisted living facility is acquired by private equity. We also see proof that the retirement home costs increases for Medicare by around 6-8%." Werner explained that research studies of retirement home during the COVID-19 pandemic found that private equity-managed institutions made out better than nursing homes that weren't included in personal equity at the time.

Report this wiki page